Notice: This press release has been automatically translated. Original German Version.

Defense Team Statement: Michael Ballweg

Defense Team’s Press Release on the 5th Day of Michael Ballweg’s Criminal Trial – November 12, 2024

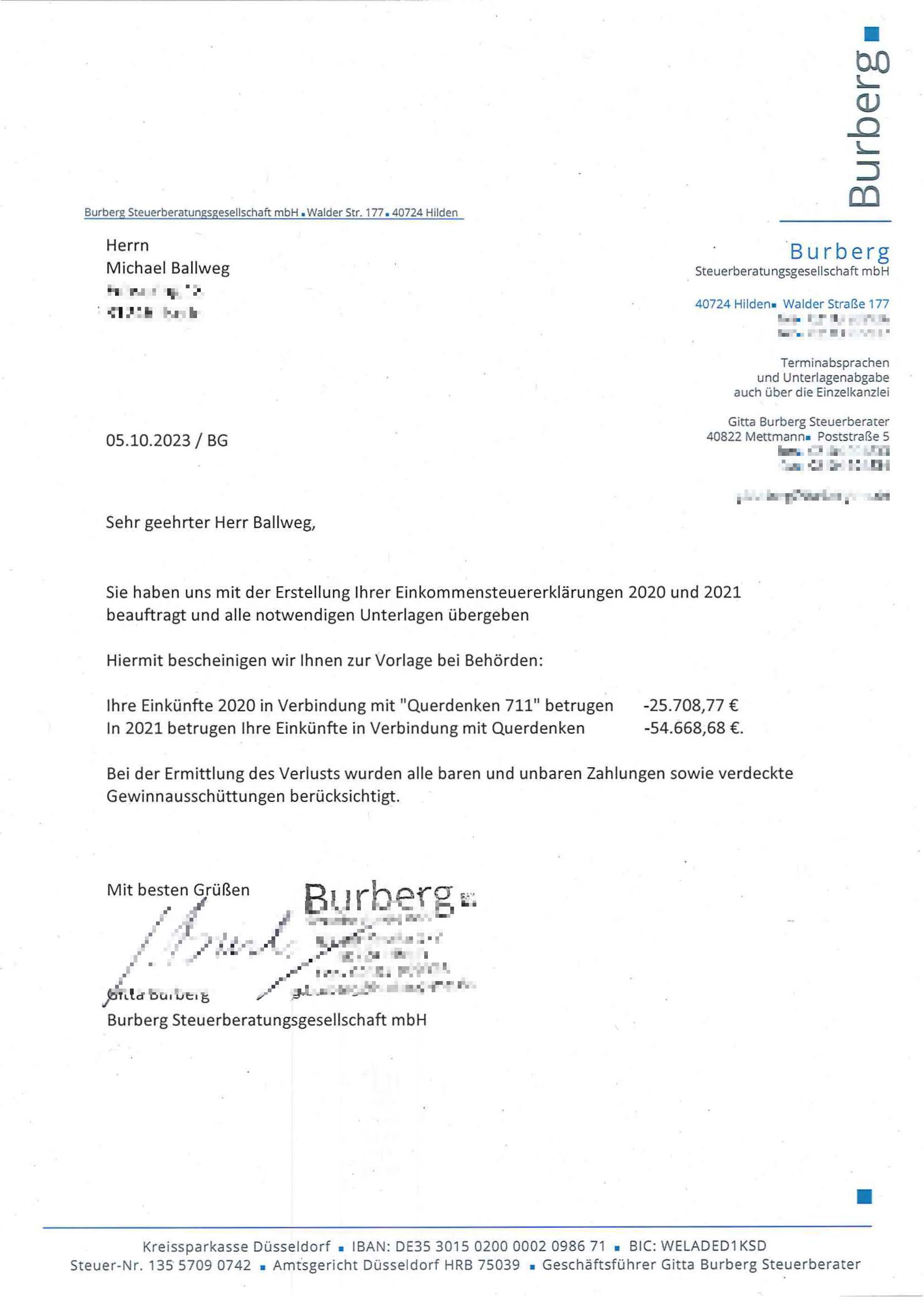

Michael Ballweg presented a certificate demonstrating that he incurred substantial losses in 2020 and 2021 – approximately 25,000 euros in 2020 and 54,000 euros in 2021. These figures cast new light on the accusations of attempted fraud and tax evasion, revealing no signs of unlawful income or tax violations.

Attorney Dr. Reinhard Löffler sharply criticized the tax authorities' approach: “The authorities seem to base their decisions on assumptions and ambiguities, without clear evidence. Today’s proceedings reveal an interpretation of the rules at my client’s expense, assuming the worst to construct a crime.”

Attorney Ralf Ludwig also questioned the testimony given by today’s witness, a government director from the Karlsruhe Tax Authority. While the witness addressed some questions substantively and took responsibility, his statements indicated that Ballweg was given exceptional treatment. “The presumption of income and commissions without specific evidence shows that efforts were made to find political grounds to harm Mr. Ballweg,” said Ludwig.

Attorney Susanne Bauknecht pointed out that there are strong indications that the special tax examination was politically motivated. “Today’s questioning again underscored that the tax investigations were initiated not due to concrete suspicions, but apparently based on suggestions and lacking substantial evidence.”

Attorney Gregor Samimi added, “Today it became clear once more that Michael Ballweg’s work was not regarded as entrepreneurial but was reported out of envy and resentment. The director of the Karlsruhe Tax Authority admitted that he might have handled the case differently had he foreseen the consequences – especially the nine-month pretrial detention for my client.”

At the end of the day’s proceedings, Michael Ballweg concluded, “We are witnessing unprecedented arbitrariness and an administrative system that has become self-sustaining. I invite all interested parties to witness this trial and experience firsthand how our justice system treats citizens who express dissenting opinions.”

The next hearing is scheduled for Thursday, November 14, 2024.

Contact

All press inquiries are handled centrally by the press team of QUERDENKEN-711 and can be submitted via the official press form: https://711.is/presseanfrage

More press releases

08/20/2025 - 44th Day of Trial – Ballweg Acquitted, Prosecution Fails on Central Allegations

07/28/2025 - Ola digital de recuerdo el 1 de agosto de 2025 – Un regalo de cumpleaños para...

07/22/2025 - 43rd Day of Trial – Grimm’s Fairy Tales More Scientific Than the Charges – De...

07/17/2025 - 42nd Day of Trial – Judge Can’t Remember, Court Wants to Dismiss, Prose...

07/16/2025 - Testimony of Former Pretrial Judge – Defense Raises Serious Allegations